5 Major Banks Offers Android Pay Integration In Their Mobile Banking Apps

Google has announced that some major banks will offer built-in Android Pay integration in their mobile banking apps. Now, you can add your credit/debit cards and use Android Pay from within mobile banking apps. The tap-to-pay experience will still be familiar, right down to getting notifications whenever you make a purchase.

In the U.S., Bank of America, USAA, and Discover are among the first to offer this native functionality. In addition, customers of Bank of New Zealand and mBank (which is based in Poland), will also see the ability added to their respective mobile banking apps.

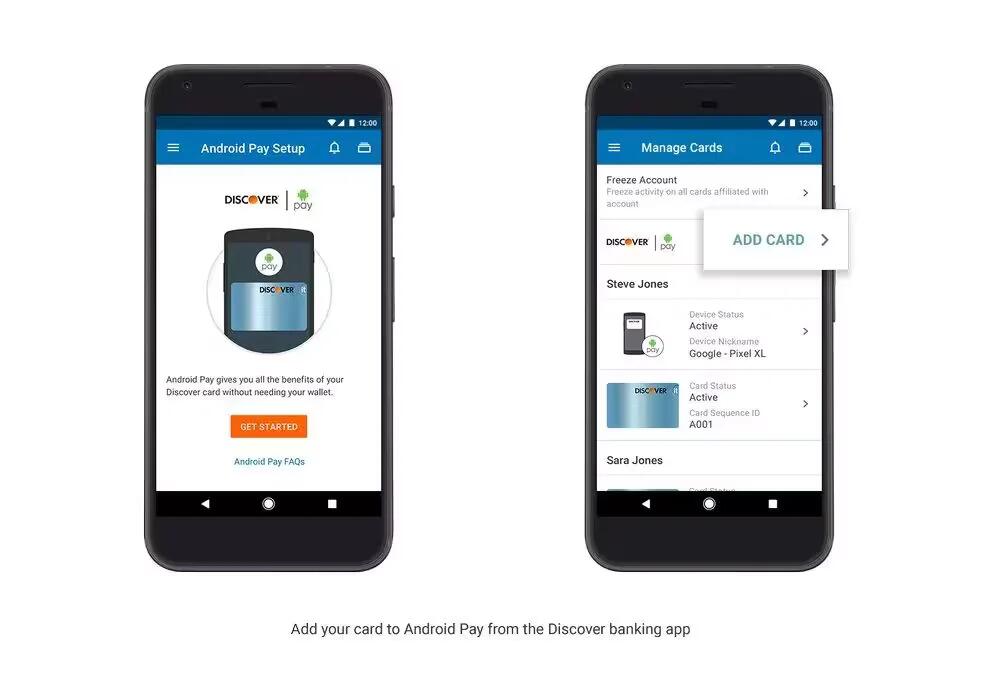

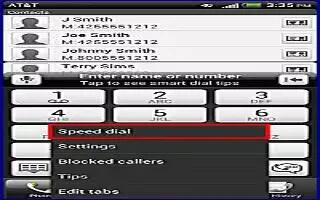

Android Pay Setup

If you are a customer of one of these banks, you can easily add cards to Android Pay from your mobile banking app with just the click of a button. After completing setup, you can use your phone to pay at stores or apps and websites that support Android Pay. You will also receive notification after each successful transaction.

The good thing about this is that you do not need Android Pay app downloaded to use the service. The aforementioned banks will offer the NFC-reliant ability within their apps. All you have to do is select your default payment card and you can experience the full capabilities of Android Pay straight within the banking apps.

mBank – Android Pay Integration

According to Google,

This latest collaboration with banks expands Android Pay’s capabilities as an open platform, and moves us closer toward our goal of empowering mobile payments everywhere. We’re continuing to integrate with additional mobile banking apps, so look for updates from your bank about this new feature.

The integration of Android Pay within banking apps will expose more people to the concept of NFC payments giving the service a larger footprint. It is also a sharp contrast with the likes of Apple Pay and Samsung Pay, where you typically have to use first-party tools to get started.

RSS - All Posts

RSS - All Posts